Spend management software brings control, visibility, compliance, and documentation to help businesses reduce costs, avoid unnecessary spending, and pay vendors or employees on time.

Businesses assign a budget for several activities like insurance, capital equipment, and inventory resupply. However, budget leaks damage your company’s profit margins when the spending stays unsupervised.

Moreover, when the business scales up, such issues will also grow in volume challenging your business profitability. Therefore, businesses of all sizes use a spending management tool to keep an eye on the money going out and keep it within the company budget.

Here’s a quick tabular summary of the best spend management software with a more detailed take in the post that follows:

| Product | Notable Features |

|---|---|

| Pleo | Streamlined expense management, integration with finance tools, cash back rewards, automated invoicing. |

| Payhawk | Automated global spend management, real-time reporting, customizable spending limits, on-time bill payments. |

| Airbase | Comprehensive spend management, advanced spend control, auditing, oversight solutions, improved purchasing decisions. |

| Zoho Expense | Automated travel and expense management, AI-powered fraud detection, budget comparison, online reimbursement. |

| Wallester Business | All-in-one expense control, real-time expense tracking, instant notifications, shared access to virtual cards. |

| Precoro | Intelligent spend management, request submission, order approval, automated procurement, transparent budget management. |

| Emburse | Complete spending tools, expense management, accounts payable, purchasing automation, travel management, data dashboards. |

| Spendesk | Automated recurring expenses, customizable spending approaches, push notifications, integrated OCR, detailed spend overview. |

| Coupa | Cloud-based business spend management, essential modules, privacy, security, integrations, business community features. |

| Mesh Payments | Spend insights, real-time payment request alerts, spend controls, spend optimization, real-time reporting. |

| Ramp | Modular spend management, expense tracking, spend policies, automated workflows, receipt matching, savings insights. |

| Brex | Speedy expense management, compliance, company expense solutions, expense tracking, spend management feature. |

| Workday | Simple spend management, intuitive interface, Source to Pay, inventory, KPI insights, cloud-based access. |

| PayEm | Advanced automation, vendor subscriptions, SaaS subscriptions, virtual credit cards, real-time spend control. |

| Teampay | Cloud-based spend visualization, real-time spending view, conversational UI, real-time data, quick spend limitations. |

| JAGGAER ONE | Source-to-Pay integration, advanced data analytics, AI and RPA, centralized spend oversight, procurement catalog. |

| RealPage | Vendor, invoice, and purchase management, smart procurement insights, automated purchase orders and approvals. |

| Concur Expense | SAP-integrated spend management, Source-to-Pay transactions, mobile expense voucher submission, intelligent automation. |

What Is Spend Management?

Spend management is the process of managing all business purchases and supplier payments. The primary goal is to account for every dollar going out from the company account and get the best value.

Spend management policies should automate and integrate all spend-linked activities from source to vendor settlement. Such granular practice should ensure procurement goes as planned by the business stakeholders.

Additionally, it enforces payment to vendors, contractors, and other third parties through the contract compliance process.

Importance of Spend Management

The standard spend management activities offer the following advantages:

- Business efficiency by automating spend and expense tracking processes that are error-prone and tedious if delegated to employees.

- Reduce risks and costs since the tool tells you about the product being procured, the vendor’s name, and the cost associated with the procurement.

- Better collaboration between business resources and third parties is achievable when you follow a standard spend management process along with a digital app.

Apart from these, it provides sustainable productivity improvements by releasing employees from mundane work and letting them complete tasks that earn revenue for your company.

Features of Spend Management Software

#1. Spending Tracking

Real-time spending monitoring is made possible by spend management software, which enables firms to keep track of every transaction, classify expenses, and find potential cost-saving possibilities.

#2. Budget Management

Businesses may define budgets for different departments, initiatives, or categories using the program. When spending gets close to certain restrictions, it provides warnings and messages, encouraging better financial restraint.

#3. Vendor Management

It makes it easier to store vendor data, evaluate their performance, and manage contracts. Better negotiating, lower risks, and enhanced supplier relationships result from this.

#4. Analytics and Reporting

Extensive reporting options offer useful insights into expenditure habits, enabling data-driven decision-making and the detection of trends that affect financial health.

#5. Policy Enforcement

By enforcing spending guidelines and compliance rules, spend management software lowers the risk of guidelines being broken and non-compliant purchases being made.

#6. Processing of Invoices

Automating the processing of invoices reduces mistakes and quickens the approval and payment cycle, improving the entire accounts payable process.

#7. Forecasting

These tools can help in the creation of precise budget projections and forecasts for future spending patterns through the examination of previous spending data.

#8. Audit Trail

Extensive audit trails make financial transactions transparent, making it simpler to follow changes and uphold responsibility.

#9. Support for Multi-Currencies

For enterprises with a global reach, support for multiple currencies makes it easier to efficiently handle spending and conversions between different time zones.

But what are the differences between spend management and expense management? Read on for a thorough understanding!

Differences Between Spend Management and Expense Management

Spend management adopts a comprehensive strategy for controlling all organizational expenses, whereas Expense management focuses on individual employee expenditures & compensation procedures.

Expense management, on the other hand, concentrates on precisely tracking and controlling individual spending; spend management is more strategic in nature and aims to promote cost efficiency and value throughout the whole procurement process.

Expense Management

- Managing expenses is largely concerned with keeping track of and reining in each employee’s particular outlays made in the course of their employment.

- It involves procedures including workflows for approval and expenditure reporting as well as reimbursement.

- The main goal of cost management systems is to make sure that staff members adhere to corporate spending guidelines and that their expenses are appropriately reported for reimbursement.

- This covers expenses for things like travel, dinner, and other incidentals. The primary objectives of expenditure management are to improve accuracy, speed up the reimbursement process, and make individual spending transparent.

Spend Management

- On the other side, spend management has a wider viewpoint and covers the complete procurement lifecycle.

- It entails budgeting, strategic planning, sourcing, handling suppliers, and a review of all outlays spent by the company.

- By locating possibilities for cost savings, negotiating advantageous contracts with traders, and ensuring adherence to spending guidelines, spend management tries to optimize expenditure throughout the organization.

- It offers information on expenditure developments, supplier performance, and potential cost-cutting opportunities.

- To maximize the value gained from expenditures, spend management, in contrast to cost management, concentrates on making smart choices and fiscal planning for the future.

The following are the best spend management solutions that enable you to bring all spending under your management and get the best value for the money you spend:

Pleo

Pleo is Europe’s leading business spending solution which offers a streamlined approach to managing your company’s expenses, invoices, and reimbursements. The software provides you with comprehensive visibility and reduces the need for manual work.

The software is trusted by more than 25k customers across Europe.

Manage your business expenses with ease and efficiency through company cards, expense management, reimbursements, and Invoices. The software allows easy integration with your account system to sync your Pleo account.

Pleo’s platform eliminates manual admin tasks, saves time, and boosts productivity. Its automation manages receipts to invoicing, freeing up staff for high-priority business activities.

Integration with other finance tools such as Xero, Quickbooks, Sage, TravelPerk, etc., simplifies the workflow of your finance team and provides complete spend visibility and easy review processes, and can generate automated expense reports.

Its cost-saving features offer up to 1% cash back on every card, leading to significant savings. Also, it provides complete transparency and control over transactions, real-time expenditure updates, customized purchase limits, and practical analytics.

Pleo helps to simplify global spending for multi-entity businesses with one account and solution, automating manual work and improving purchasing decisions. In terms of security, the data adheres to strong security standards for PSD2, Mastercard’s Zero Liability Policy, PCI DSS, and GDPR. Pleo is free to use for up to 3 users.

Payhawk

Payhawk is a spend management platform for businesses across Europe and the US that automates global spend management, reduces manual processes by 87%, and enables on-time bill payments and customized spending limits.

The platform utilizes approval workflows, accounting integrations, and real-time reporting to manage and govern spending.

The software helps to track and monitor every business expense and transaction in real-time with expense management software. It provides insights for planning and forecasting while sharing reports with stakeholders and senior management.

You can trace all payments by connecting employee-specific corporate visa cards and setting spending limits for individuals and teams.

The platform provides budget owners with live updates on their project expenses, enabling them to evaluate actual and anticipated spending and monitor the available budget.

Payhawk’s platform allows the creation of spending policies utilizing sophisticated workflows and the facilitation of card controls, including recurring transaction limits, ATM withdrawals, and approval hierarchies.

Through the automation of operations and the provision of an exclusive IBAN for bill payments via SEPA Instant and Faster Payments, Payhawk effectively reduces monthly closing times by up to five days.

Airbase

Airbase is a comprehensive spend management tool for different types of businesses, like early-stage companies, small businesses, mid-market companies, pre-IPO businesses, and enterprises. It offers a bunch of advanced spend control, auditing, and oversight solutions.

For example, the Receipt Management module offers enforcement of compliance, effortless receipt attachment, dedicated emails, sharing receipts from another device, etc.

Also, there are Security and Fraud Detection module to enable card control, card limits, card blocking, fraud detection, fraud notification, encrypted sharing of virtual card details, etc.

Zoho Expense

If you are a growing business, Zoho Expense is an ideal solution for travel and expense management. It helps businesses automate expense reporting, simplify corporate travel, control spending, and gain vital financial insights.

Moreover, the solution uses AI-powered technology to detect fraud so that you can perform better audits and stay prepared for the tax season.

With Zoho Expense, managing online and offline booking becomes a seamless task for end-to-end travel desk management. It also automates the expense creation from the receipts and eliminates manual errors through the online reimbursement process.

This application also enables you to compare your budget with your actual expense. Automated purchase requests, activity tracking for audit trail, and contextual and real-time collaboration between the departments are other top features of the solution.

Wallester Business

Wallester Business is an all-in-one business expense control software. Companies can manage all corporate spending from one platform as you can track all the expenses in real-time. Using this platform, you can issue virtual cards to your employees in minutes to cover corporate expenses.

You can even offer shared access to virtual cards to multiple people working on the same project. These business cards are highly secured with a 3D secure 2.0 system. Moreover, it shares instant notifications to reduce the chance of fraud cases.

Businesses can even track their progress toward budget limits and get alerts when they exceed their limits. Setting up daily and monthly limits for individuals, multiple payment methods and cash withdrawals, categorizing transactions and attaching receipts to these are other highlighted features of this software.

Precoro

Precoro is an award-winning intelligent spend management platform. It helps businesses with spending workflow control through request submission, order approval, and cost transparency.

It addresses challenges such as delayed approvals, erroneous manual procedures, disorienting workflows, poor documentation, inadequate reporting, and ineffective budgeting.

The platform helps to automate spending workflow processes to establish transparency, consistency, and efficient budget management.

To ease the business operations, Precoro streamlines end-to-end procurement management such as processes for request collection, approval workflow creation and purchasing document oversight, etc.

Precoro is adaptable software that can be customized according to your company’s purchasing approach, type of business, and size. It allows you to control operations, customize document fields to meet your specific requirements, establish criteria-based approval workflows, and design user roles.

The platform provides straightforward and effective Procurement and spending management solutions to all related teams to work with suppliers inside and outside the organization. On top of this, it streamlines finance teams by eliminating manual invoicing, approvals, bank statement matching, etc.

Its pricing is simple and user-based that can be customized based on your business type.

Emburse

Emburse offers complete tools for spending management for startups to big multinational companies. Its solutions include expense management, accounts payable, purchasing automation, streamlined payment system, audit, travel management, and data dashboards.

Emburse offers virtual cards that can be issued right through its platform, using a tool called Emburse Spend. Emburse’s virtual cards seamlessly integrate with the software used by accounting and AP teams, including Emburse Chrome River, Emburse Certify, or one of the other products offered. Products like Emburse Go help travel managers keep a close eye on their travelers and their expenses.

The best thing is Emburse’s modular approach for business spend management, depending on company size. Emburse Tallie works well for small to medium-sized businesses. Emburse Certify works well for US-based enterprises.

Emburse Chrome River works well for large enterprises with operations, regardless of where the office is based. Major firms like Microsoft, Nike, and Estee Lauder use Emburse’s software.”

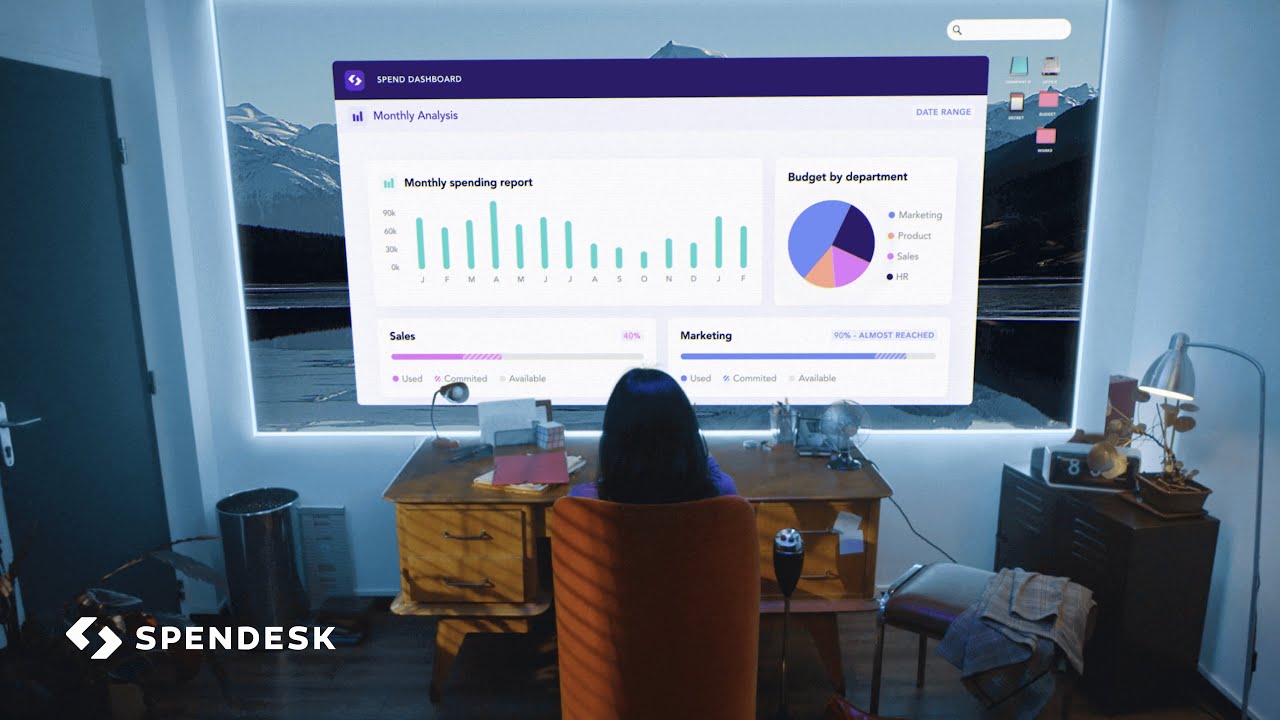

Spendesk

Spendesk has many helpful and intuitive features, including integrations and Optical Character Recognition (OCR). With this tool, your company can automate all the recurring expenses. Moreover, it’s powerful enough to match expense claims to the respective invoice and save time.

Spendesk is also a flexible tool so that companies can customize it according to their spend management approaches. For example, you assign debit cards for specific spending to individual staff. In addition, you may also assign virtual credit cards for single-use purposes.

Additionally, it offers push notifications for payment validation, accounting tool integration, a point-in-time overview of expenses, and a comprehensive spend overview dashboard.

Coupa

Coupa is another popular tool for business spend management (BSM) with cloud access. It can manage spending across various business verticals like payments, supply chains, procurement, treasury, etc. There are three stacks of tools for convenient spend management.

The first stack of tools is the Applications. This stack covers all the essential modules like procure, invoice, expense, pay, contract management, strategic sourcing, spend analysis, etc.

The 2nd stack is the BSM platform that focuses on user privacy, profile, data security, and integrations. It includes a connected core, cloud access, integrations, graphical user interface (GUI), etc.

And lastly, the 3rd stack is the Coupa business community. It offers features like an open business network, Coupa advantage, and community AI.

Mesh Payments

Mesh Payments is yet another software that you can use and stop spending leakages. First off, its Spend Insights functionality brings you valuable data insights just when you need them. Whenever you view a spend item, its mobile app automatically shows savings opportunities in the future, spend forecasting at the present rate, etc.

Secondly, its Spend Controls module gets you real-time payment request alerts, lets you limit spend, cancel subscriptions from one central interface, and block vendor payments with a single click. Other notable features are Spend Optimization, Real-Time Reporting, and Automated Payment workflow.

Ramp

Ramp has divided its business spend management system into 4 mega modules: Start, Scale, Streamline, and Save. The Start module gives you access to tools to manage several cards, bill payments (ACH/checks/cards), real-time expense tracking, and accurate spend accounting.

Scale module enables you to enforce business policies around spending and expenses. For example, you can use expense policies to set rules and spend controls to enforce these spending guidelines.

Streamline module offers you several workflows (Onboarding, Collaboration, and Accounting) to automate spend management and integrate (1000+ integrations) it with other business tools. Lastly, the Save module is there to cater to your needs for receipt matching, expense categorization, price intelligence, savings insights, etc.

Brex

Brex is all about speeding up business operations finances while complying with the company policies for spending and expenses. By enabling the employee to submit accurate expenses and the accounting team to audit the expenses effortlessly, Brex develops a culture of financial discipline among the company and its human resource.

Brex offers various company expense management solutions like credit cards, business accounts, expense tracking, integrations, etc. It’s also bringing the spend management feature for the Brex Empower subscription.

Workday

Workday, the renowned human capital management tool, also started offering simple and strategic ways to manage business spends. It comes with an intuitive, simple, and lightweight graphical user interface for spend management from one centralized platform.

Its UI has 3 basic tabs: Source to Pay, Inventory, and KPIs. The Source to Pay module gives valuable data insights on Supplier Spends, Managed vs. Unmanaged Spend, Supplier performance, Invoice Processing, etc.

Moreover, it’s a cloud-based app so that you and your business stakeholders can keep an eye on company spend from any device and anywhere with an internet connection.

PayEm

PayEm is all about advanced automation in the spend management vertical of your business. It brings vendor subscriptions and SaaS subscriptions for employees in one place. Thus, you don’t need to buy separate software for different spend heads.

On PayEm, you can create and issue virtual credit cards for different third-party vendors and assign a point of contact person for spend management. You can also apply the same strategy to software subscriptions.

Moreover, you get the ultimate spend control authority on PayEm. Thus, you can stop overspending on software subscriptions by removing unnecessary apps or former employee accounts from existing apps.

Teampay

Teampay’s cloud-based app puts the finance teams in the driver’s seat so that they can visualize all the spends from different verticals of your business. Company stakeholders also get a real-time view of everyday spending and can make quick spend limitations if needed.

It also offers a conversational UI so that employees can get real-time assistance from the finance team to know the buying process or get transaction approvals. Moreover, you don’t need to wait for the next month’s bill to understand how your employees are spending. You’ll get real-time data on current spending.

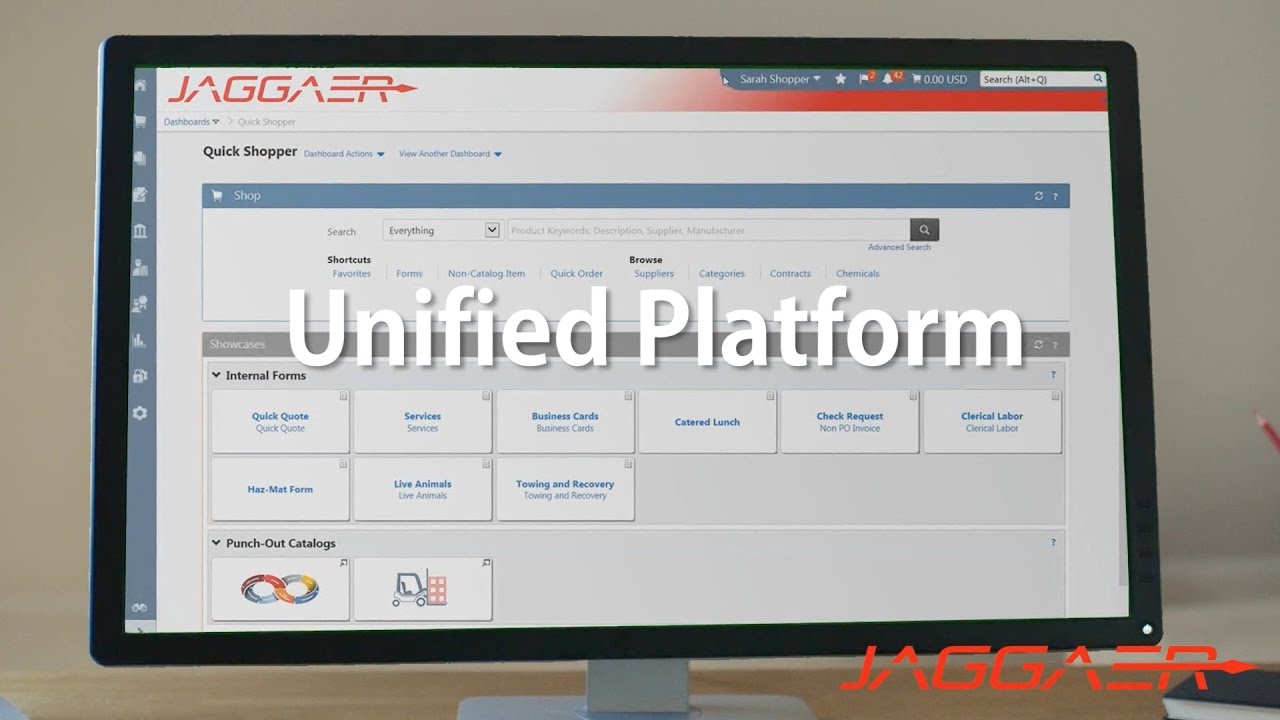

JAGGAER ONE

JAGGAER ONE is also a popular name for Source-to-Pay activities that brings all spends from different verticals into one place for easy supervision of company expenditures. Its thoughtfully designed app enables you to manage indirect and direct expenses from one simple tool.

It offers highly advanced data analytics and insights by combining AI and Robotic Process Automation (RPA). Thus, you can get actionable data to restructure the spend management process, like creating a procurement catalog for the entire business.

RealPage

RealPage helps you become cost-efficient and productive when you manage vendors, invoices, and purchases on this tool. It’s not just a mere spend tracking tool.

It gathers spending and earning data of all the business portfolios of your company and offers you data insights for smart procurement. Moreover, it helps you automate all purchase orders (POs) and their approval processes with real-time data feed to a central dashboard for spend oversight and analysis.

Concur Expense

Concur Expense is a spend management offering from SAP, the renowned business operations ERP software developer. The product helps you integrate and automate business spend management by linking several Source-to-Pay transactions.

The tool is beneficial for both the employee and employer. For example, field employees can submit their expense vouchers from a mobile. Concur’s intelligent program will automatically verify the expense and send you a notification so that you can approve the spend faster.

Final Words

By utilizing a spend management software, you can plug the holes that drain money unknowingly and cushion your company for profit margin. You may also require one of the best expense trackers if your business has to reimburse recurring payments made by employees or vendors.

-

Tamal is a freelance writer at Geekflare. After completing his MS in Science, he joined reputed IT consultancy companies to acquire hands-on knowledge of IT technologies and business management. Now, he’s a professional freelance content… read more